Direct materials are raw materials costs that can be easily and economically traced to the production of the product. Advantages include increasing the efficiency and profitability of your business, cost control, and new able account advantages improving your decision-making process in future endeavors. Disadvantages include the extra work and commitment it takes and investment in new technology like payroll processing services and accounting software.

Using a Predetermined Overhead Rate

- What may be a direct labor cost for one company may be an indirect labor cost for another company or even for another department within the same company.

- In the preceding sections, an organization-wide predetermined manufacturing overhead rate was calculated.

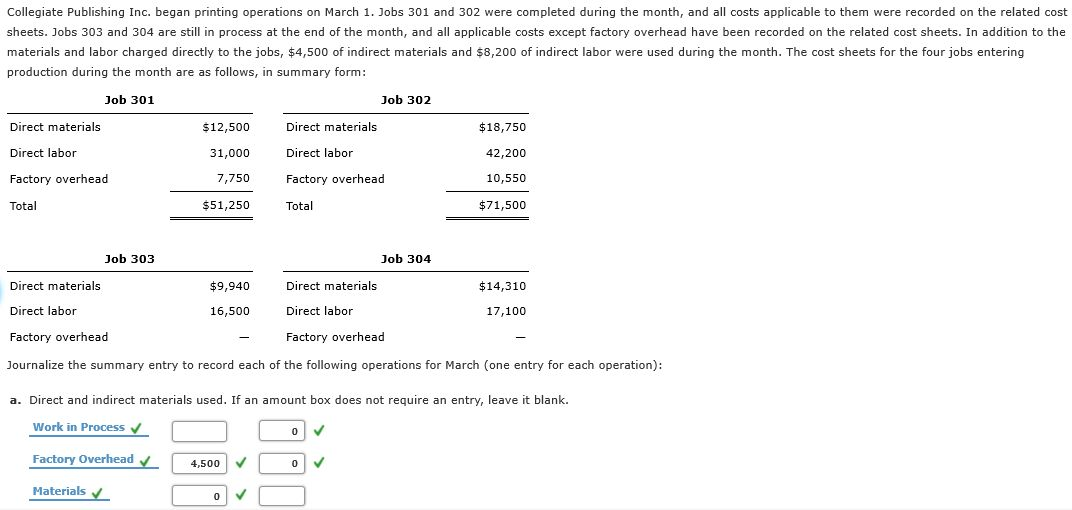

- The processes to solve the following scenario are demonstrated in Video Illustration 2-3 below.

- Likewise, the $50,000 balance of labor cost that includes both direct labor and indirect labor will become zero after the journal entry.

- All manufacturing, or product costs, that are not direct material or direct labor, are recorded in the Manufacturing Overhead account.

When the product is sold, the costs move from the finished goods inventory into the cost of goods sold. Direct labor is manufacturing labor costs that can be easily and economically traced to the production of the product. The inventory asset accounts and expense accounts used in a job-order costing system are discussed in detail in this section. The accounting terms of debit and credit are used to identify the increases and decreases made to each account during the process.

Fringe Expenses

And then this cost will be transferred to the production in order to add up to the cost of units being produced which is usually called work in process. When Dinosaur Vinyl requests materials to complete Job MAC001, the materials are moved from raw materials inventory to work in process inventory. We will use the beginning inventory balances in the accounts that were provided earlier in the example. The requisition is recorded on the job cost sheet along with the cost of the materials transferred. The costs assigned to job MAC001 are $300 in vinyl, $100 in black ink, $60 in red ink, and $60 in gold ink. During the finishing stages, $120 in grommets and $60 in wood are requisitioned and put into work in process inventory.

Multiple predetermined manufacturing overhead rates LO6

First, a debit is made to the cost of goods sold account and a credit is made to the finished goods account. Last, a debit is made to the accounts receivable account and a credit is made to the sales revenue account. This entry accounts for the funds owed to the company and the recording of sales. In the accounting of job order costing, the labor cost account is usually used for recording the labor cost that incurs during the period including both direct labor and indirect labor.

Personnel working in accounting, marketing and engineering departments are some examples of administrative indirect labor employees. Direct labor costs refer to the wages and salaries paid to employees who are directly involved in the production of a specific product or the provision of a specific service. These costs are directly traceable to the individual units being manufactured or the specific jobs being performed. In this journal entry, the labor cost account includes both direct labor and indirect labor. And the payroll taxes payable account is a current liability account that the company owes to the applicable governing authorities. In job order costing, the direct labor will be transferred to the working in progress account while the indirect labor will be transferred to the manufacturing overhead account.

Video Illustration 2-3: Applying manufacturing overhead to jobs LO4

The costs are tracked from the materials requisition form to the work in process inventory and noted specifically as part of Job MAC001 on the preceding job order cost sheet. Second, the manufacturing overhead account tracks overhead costs applied to jobs. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. You saw an example of this earlier when $180 in overhead was applied to job 50 for Custom Furniture Company. Work in Process (WIP) is the inventory account where product costs including direct material, direct labor, and manufacturing overhead are accumulated while the jobs are in the manufacturing process.

Therefore, these expenses are debited to the manufacturing overhead account and credited to the wages payable account. As jobs are completed, these overhead costs will be applied to products through an allocation process. Then, these costs including the $20,000 of indirect labor will be transferred further to the working in process account using the predetermined overhead rates. Manufacturing overhead is applied to jobs using a predetermined manufacturing overhead rate.

Direct labor can be analyzed as a variance over time, across products, and in relation to other process, equipment, or operational changes. The main difference between direct and indirect labor costs is the underlying fact that direct labor can be directly attributed to a certain product. On the other hand, it can be seen that indirect labor cannot be directly attributed to any given product. Direct materials are those materials that can be directly traced to the manufacturing of the product. Some examples of direct materials for different industries are shown in Table 4.2. In order to respond quickly to production needs, companies need raw materials inventory on hand.

Implementing these best practices can help businesses manage labor costs and maximize their workforce’s efficiency and productivity. Furthermore, an accountant who delivers services to clients, on the other hand, would be called direct labor because they are directly involved in providing the business’s services. Below we have listed a chart that shows a variety of common jobs and whether they should be classified as direct or indirect labor. Suppose, you’re an experienced attorney who employs a receptionist and a trainee assistant. Despite the fact that both of your employees contribute significantly to the success of your practice, they are both classed as indirect labor because none provides direct client service. A clearing account is used to hold financial data temporarily and is closed out at the end of the period before preparing financial statements.