The D/E ratio is a financial metric that measures the proportion of a company’s debt relative to its shareholder equity. The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations. The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt. It is calculated by dividing the total liabilities by the shareholder equity of the company. The debt-to-equity ratio (D/E) compares the total debt balance on a company’s balance sheet to the value of its total shareholders’ equity. The D/E Ratio is a powerful metric, and when used correctly, it can provide invaluable insights into a company’s financial stability and risk profile.

What is considered a good debt-to-equity ratio?

Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds. However, if the cost of debt interest on financing turns out to be higher than the returns, the situation can become unstable and lead, in extreme cases, to bankruptcy. The D/E ratio illustrates the proportion between debt and equity in a given company. In other words, the debt-to-equity ratio shows how much debt, relative to stockholders’ equity, is used to finance the company’s assets. Gearing ratios are financial ratios that indicate how a company is using its leverage.

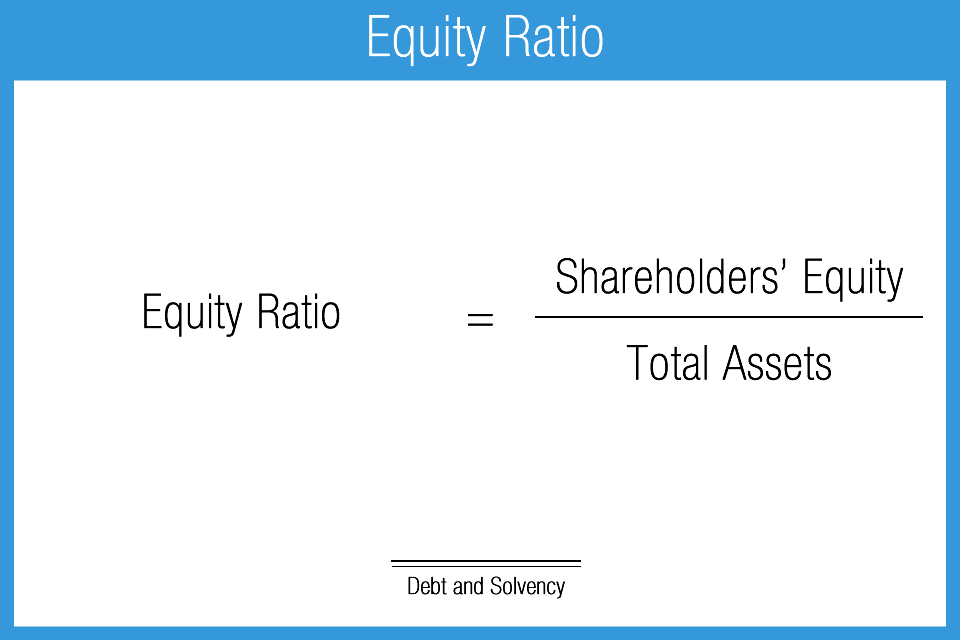

What is the Debt to Equity Ratio Formula?

The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. Understanding the average Debt to Equity ratio in your industry helps contextualize your company’s financial standing. This comparison can inform strategic decisions regarding financing and growth. Companies can manage their Debt to Equity ratio by controlling debt levels and increasing equity through retained earnings or issuing new shares. If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk.

Lessons learned and insights gained from D/E Ratio analysis

This method is stricter and more conservative since it only measures cash and cash equivalents and other liquid assets. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk.

The Debt/Equity Ratio: A Comprehensive Analysis

The long-term D/E ratio for Company A would be 0.8 vs. 0.6 for company B, indicating a higher risk level. A highly leveraged company with a high D/E ratio faces increased financial risk. During economic downturns or challenging market conditions, the company may struggle to meet debt obligations, leading to potential default and loss of investor confidence. On one hand, leveraging (using debt) can magnify a company’s return on equity and be a sign of an aggressive growth strategy. On the other hand, it increases the company’s exposure to risk, particularly if the market turns unfavourable.

How to calculate the debt to equity ratio?

The debt/equity ratio serves as a critical tool for financial analysis, offering valuable insights into a company’s financial leverage and risk profile. Investors, creditors, and analysts leverage this ratio to assess a company’s creditworthiness, financial stability, and investment potential. The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity.

But if a company has grown increasingly reliant on debt or inordinately so for its industry, potential investors will want to investigate further. When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another. Assessing whether the components of an operations management aggregate plan a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. The D/E ratio indicates how reliant a company is on debt to finance its operations. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt.

If they’re low, it can make sense for companies to borrow more, which can inflate the debt-to-equity ratio, but may not actually be an indicator of bad tidings. A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt.

Whether the ratio is high or low is not the bottom line of whether one should invest in a company. A deeper dive into a company’s financial structure can paint a fuller picture. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. Conversely, a low number indicates a conservative approach to financing, with the company relying more on equity than debt. This is generally safer, but it could also mean the company is not utilizing opportunities to leverage its operations and maximize shareholder value.

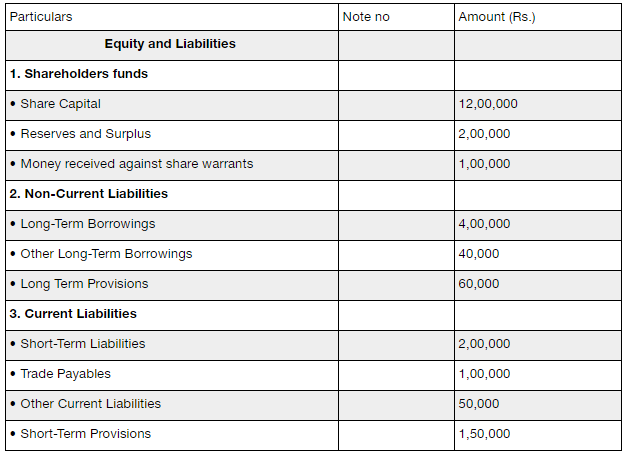

- From the above, we can calculate our company’s current assets as $195m and total assets as $295m in the first year of the forecast – and on the other side, $120m in total debt in the same period.

- A debt to equity ratio of 1 would mean that investors and creditors have an equal stake in the business assets.

- This means that investors own 66.6 cents of every dollar of company assets while creditors only own 33.3 cents on the dollar.

- However, this will also vary depending on the stage of the company’s growth and its industry sector.

Restoration Hardware’s cash flow from operating activities has consistently grown over the past three years, suggesting the debt is being put to work and is driving results. Additionally, the growing cash flow indicates that the company will be able to service its debt level. As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware.

Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio. For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations. But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk. On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either. For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly.